A report on seniors, with notes on child poverty, housing, and finally, some music to contemplate it all by.

In the wake of news about an elderly New Brunswick couple in care, married for 69 years, who were separated just before Christmas this year to accommodate the husband in a facility about 45 minutes away from the wife’s facility because of his need for a higher level of care for dementia, our thoughts can turn to the increasing number of seniors in BC. The BC Seniors’ Advocate released a new report on December 14, focusing on the 25 programs available for BC seniors.

Two key concerns are expressed in the report; one is the increase in need for home support services, concurrent with the decrease in the availability of those services; the report states, “We know there are up to 15% of seniors living in residential care who could live in the community with proper supports.” Residential care is more expensive than providing adequate home support, the report notes.

The next key concern is the increasing “lack of affordability” for senior renters.

Here are a few quick numbers: The report counts 882,731 seniors (people over the age of 65) living in BC.

Nearly a fifth of those seniors ̶ 19% ̶ rent their accommodation; the poverty rate for seniors has increased by 24% since 2005; and, since 2005, the maximum rent eligible for a rent subsidy (SAFER, Shelter Aid for Elderly Renters) has increased by 9%, while during that same period rents have increased by 45%.

81% of BC seniors own their own homes, and about a quarter of them are still paying mortgages. To help make ends meet, 94% more seniors than in the previous year are taking advantage of the province’s property tax deferral program. This program is not free money ̶ it just means that the deferred taxes are a low-interest loan from the province, secured by a lien on the property, and the loan must be paid when the property changes hands. For more information on deferring property taxes, click the link above.

More about housing: since 2013/14, the number of subsidized housing units has decreased by almost 5%; and last year alone, the number of people aged 55 and over waiting for a unit increased by nearly 16%.

The province of BC supplies a monthly “top-up” that can be added to the federal Guaranteed Income Supplement for those eligible. Notwithstanding the increase in poverty rate for seniors, according to the Advocate’s report, the maximum monthly top-up payment of $49.30 for a single senior has not changed since 1987.

For those with an appetite for detail, here’s a link to the full report:

http://www.seniorsadvocatebc.ca/app/uploads/sites/4/2017/12/MonitoringReport2017.pdf

Thinking of our seniors and the wealth gap leads to thinking of the effects of gross disparity in income on others, too. In our region, affordable housing for all low-income people is a challenge. The Lower Columbia Community Development Team Society has an Attainable Housing Committee working on the issue, and with the help of the federal and provincial governments and Columbia Basin Trust, it has had some success in creating a few additional affordable housing units. And now Columbia Basin Trust has just announced a new pot of funding for affordable housing.

The Kootenays were well represented in responding to a research project on affordable housing, done for BC Housing by the Whistler Centre for Sustainability. The report found a great need for affordable “workforce housing” ̶ translation: low-cost housing for people working for low wages in the service industry.

In our region the “Getting to Home” project has been tackling the problem of homelessness. This is a reminder that, while many seniors are living in poverty, they are not alone in that, and our society continues to see greater disparity in wealth between the well-off and the poor at all ages.

The ratio of children living in poverty in BC has remained roughly the same for the past 20 years, according to the “BC Child Poverty Report Card.” One in five children are defined as living in poverty.

How is “poverty” defined? Canada has no official measure of poverty; it’s a complex matter, and three different measures have been developed: the “low income cut-off” or LICO; the “low income measure” or LIM; and the “market basket measure” or MBM. For an explanation and comparison of the three different approaches to measuring poverty, go to https://www.cpj.ca/content/making-sense-poverty-measures.

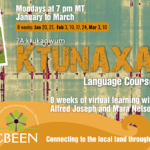

Suggested musical accompaniment for this item can be found here.