Opinion: A business case for Trans Mountain expansion? A close look at the data

By David Huntley; republished with permission from Watershed Sentinel

The Trans Mountain Expansion pipeline is being built to transport Alberta’s diluted bitumen to tidewater and then by tanker to overseas markets. In 2011, the National Energy Board gave Trans Mountain priority access for 79,000 barrels of oil per day for ten years on the existing branch pipeline to Westridge Marine Terminal, so that new overseas markets could be developed in Asia and elsewhere.1 The oil companies have had nine years to develop these new markets and have failed in this task. So why build the new pipeline? Construction should be paused until a new business case is made for it.

The existing Trans Mountain pipeline has carried Alberta oil to tidewater at Westridge terminal in Burnaby, British Columbia for over six decades. Westridge has been used to load tankers with oil for delivery to overseas markets, primarily in California. But this current use of the tanker terminal is only a small fraction of its capacity, and the terminal is rarely used to ship oil to Asia except when the oil price is extremely low.

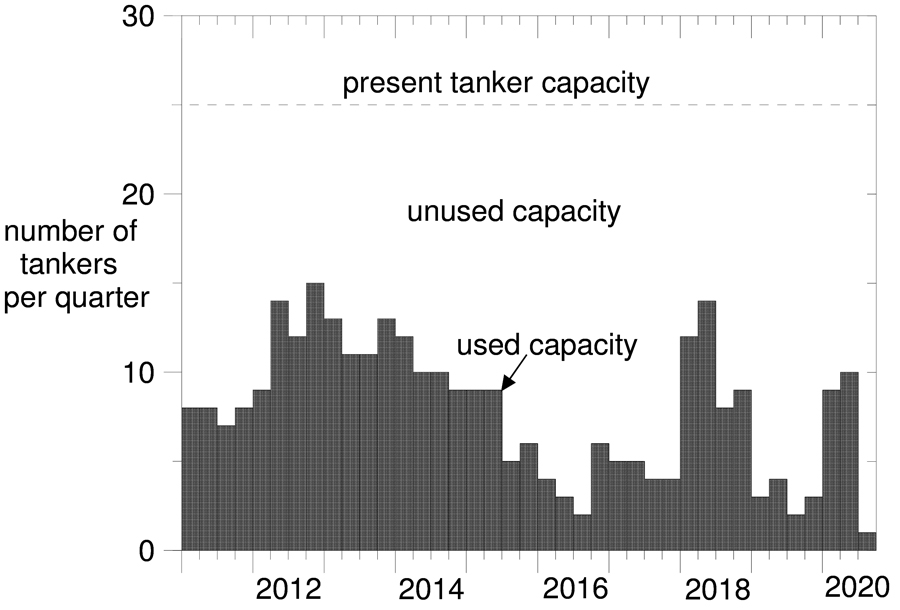

An Aframax tanker, the largest that can service the Westridge terminal, takes up to 600,000 barrels of oil and loads in just over two days. The terminal can readily load one hundred such tankers a year, 25 per quarter. This is indicated by the dashed horizontal line shown near the top in Figure 1. The actual number of tankers loaded from 2011 to the present is shown by the shaded area. The empty space between is the unused capacity. About half of the tankers represented in Figure 1 are the smaller Panamax size, which only take about one day to load; thus the actual unused capacity is larger than indicated.

figure 1 | data source: Crude Oil and other Tankers at the Trans Mountain Westridge Marine Terminal in Burrard Inlet, Burnaby, BC, David J. Huntley, October 1, 2020

The 79,000 barrels-a-day priority would fill about a dozen Aframax tankers per quarter or nearly twice that many Panamax tankers. This priority volume has never been reached; the data on actual oil shipments show that, since 2012, usage varied between 18 % and 77 % of the guaranteed amount.2

Since 2014, there have been 178 tankers loaded at Westridge; 144 of them went to the USA (nearly all to California), 29 went to China, three went to South Korea, one went to India and one went to New Brunswick. This is less than 30 % of the tankers that could have been loaded. If a higher price was available in Asia, as is claimed, all the tankers would have gone there; the inference then is clearly that a higher price is not available in Asia.

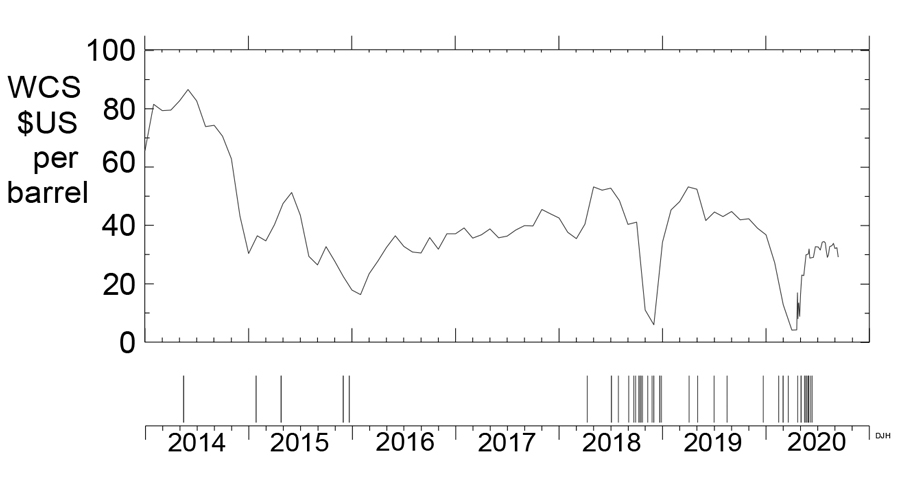

figure 2 | data source: Crude Oil and other Tankers at the Trans Mountain Westridge Marine Terminal in Burrard Inlet, Burnaby, BC, David J. Huntley, October 1, 2020

So why do any tankers go to Asia? The answer is very clear in Figure 2, which shows that tankers mainly go to Asia when there is an exceptionally low price for Western Canada Select (WCS, a heavy oil composed of bitumen diluted with condensate). The upper part of the figure shows how the price has varied with time, and the lower part shows a vertical line for each tanker that went to Asia.

In late 2018 there was such a glut of WCS in Alberta that the price plummeted to about US$11 per barrel, less than one-third of normal value. Ten tankers went to China in this period. Then the Alberta Premier ordered a curtailment in oil production. The price returned to normal and oil shipments to China stopped. In March and April 2020 the world price of oil collapsed and eight tankers went to China.

Alberta oil has had access to tidewater for decades and has used it at only a fraction of the capacity of the Westridge Terminal.

Not all tankers to Asia fit this pattern. Oil companies may have been trying to develop Asian markets by offering tanker loads at bargain prices; this is standard procedure according to Rex Tillerson, former CEO of Exxon.3 From 2017 to the present, the tankers travelling to China have gone to 14 different ports with seven ports receiving two or three tankers and the rest, just one tanker. This leads one to infer that there are no long-term contracts because a long-term contract would result in regular or somewhat regular shipments. There have not been any.

The long-term view is that Alberta oil exports to overseas markets do not look promising because shipments to Asia have been sporadic except when the WCS price is very low.

The short term view is no better. Between April 7 and September 23, 2020, no tankers went to the USA. In this gap, there was the flurry of eight tankers to China associated with the general oil price collapse. Following them, a single tanker went to New Brunswick in an attempt to develop a market there. It departed on June 20, over three months ago.

In conclusion, the data show that Alberta oil has had access to tidewater for decades and has used it at only a fraction of the capacity of the Westridge Terminal. Alberta oil has not even used all of the access guaranteed by the National Energy Board and has used its access to world markets at only at a fraction of its potential.

It is difficult to envisage the Trans Mountain Expansion pipeline being used much if it is completed. A new business case for building the pipeline is needed. There may not be one.

Detailed documentation is available in a 34-page report: Crude Oil and other Tankers at the Trans Mountain Westridge Marine Terminal in Burrard Inlet, Burnaby, BC, David J. Huntley, October 1, 2020. I am very grateful for help from Robyn Allan, Nelson Bennett, Ted Fullerton, and the Pacific Pilotage Authority.

David Huntley is Professor Emeritus in the Department of Physics at Simon Fraser University. He may be reached at huntley@sfu.ca

- National Energy Board: Reasons for Decision, RH-2-2011, Firm Service to Westridge Marine Terminal, December 2011, page 28

- R. Allan and M. Eliesen, June 27, 2019, Submission to the B.C. Utilities Commission: An enquiry into gasoline and diesel prices in British Columbia. ~ Project No. 1599007. page 33

- Rex Tillerson in: Exxon Mobil Corporation: Analyst Meeting, New York, NY, March 4, 2015, page 6