What Rosslanders need to know about their property taxes

Property Tax payments are due Monday, July 4, 2022 by 4 p.m.

All unpaid taxes; including unclaimed home owner grant amounts that are not paid as of the due date are subject to a 10 per cent penalty. This penalty is a provincially legislated requirement and cannot be reversed by staff, under any

circumstances.

Don’t delay, claim your home owner grant today!

There are TWO ways to claim the annual Home Owner Grant:

1. Online with the Province of BC at: www.gov.bc.ca/homeownergrant

2. By phone at 1-888-355-2700

The City cannot accept your Home Owner Grant (HOG) application; however, if you require assistance, there is a self-serve computer available at City Hall. You will need your Social Insurance Number.

CAN I DEFER MY PROPERTY TAXES?

If you are 55 or older, a surviving spouse of any age, or a person with a disability and are unable to pay your property taxes this year, you may be eligible to defer payment. Visit the Province of BC website to see if you are eligible. For more information call 1-888-355-2700 or email: taxdeferment@gov.bc.ca.

PAYMENT METHODS

For any type of payment, please allow for sufficient time for processing. The amount due is based on if you qualify for a Home Owner Grant. You will need to pay the amount in the column that applies to you.

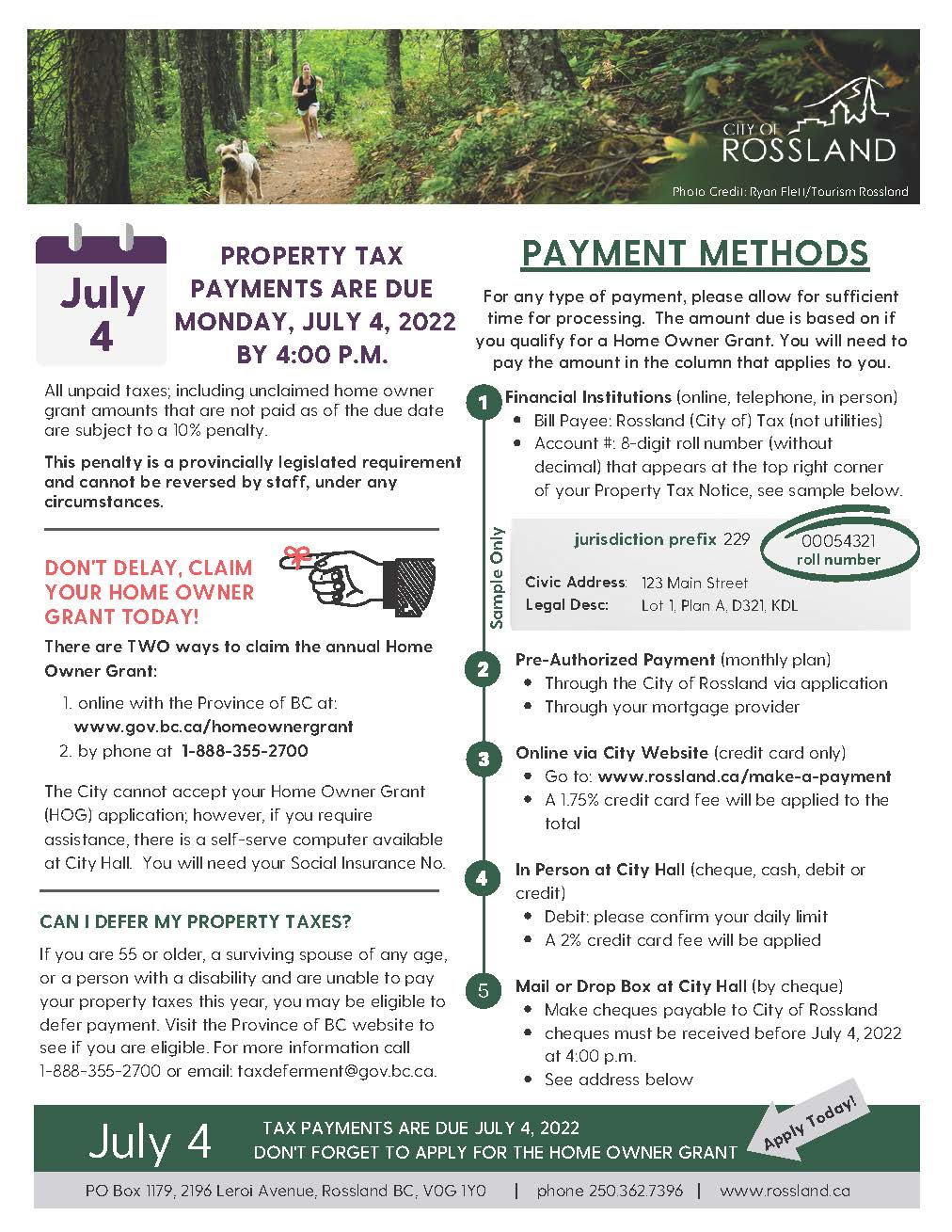

1. Financial Institutions (online, telephone, in person) Bill Payee: Rossland (City of) Tax (not utilities) Account #: 8-digit roll number (without decimal) that appears at the top right corner of your Property Tax Notice.

2. Pre-Authorized Payment (monthly plan)

- Through the City of Rossland via application

- Through your mortgage provider

3. Online via City Website (credit card only)

- Go to: www.rossland.ca/make-a-payment

- A 1.75% credit card fee will be applied to the total

4. In Person at City Hall (cheque, cash, debit or credit) Debit: please confirm your daily limit . A two-per-cent credit card fee will be applied

5. Mail or Drop Box at City Hall (by cheque) Make cheques payable to City of Rossland, cheques must be received before July 4, 2022 at 4 p.m. See address below”

PO Box 1179, 2196 Leroi Avenue, Rossland BC, V0G 1Y0

For more information, phone 250.362.7396 or visit www.rossland.ca