Opinion: Taxation and us

Taxes – who wants to think about taxes at this time of year? Can’t we put it off for a few months?

Relax – this isn’t about doing the dreaded tax return. It’s about trends in taxation, and what they achieve. Or not. And what voters can do about it. Besides, it can take your mind off the stress of the holiday season for a few minutes.

Lowering taxes on large corporations and the wealthy people who profit from them was once promoted as a benefit to the economy as a whole, including the lower-income workers who keep those companies profitable. Called “trickle-down economics,” that idea has been debunked several times over. One article claims that it began as “a joke” – literally — and that it remains a joke.

A June, 2019 article in The Guardian includes these two paragraphs about taxation in the U.S.:

“Each and every time state or federal governments have tested Laffer’s trickle-down theory, deficits balloon, rich folks hoard their wealth at the top, and average Americans suffer.

“The greatest periods of growth in our country, such as the 1950s and 1990s, have coincided with decisions to raise taxes on wealthy individuals and corporations.”

I have referred to “trickle-down” as “piss-on-the-poor” economics, because that’s the end result – figuratively, at least. Along with infrastructure deficits.

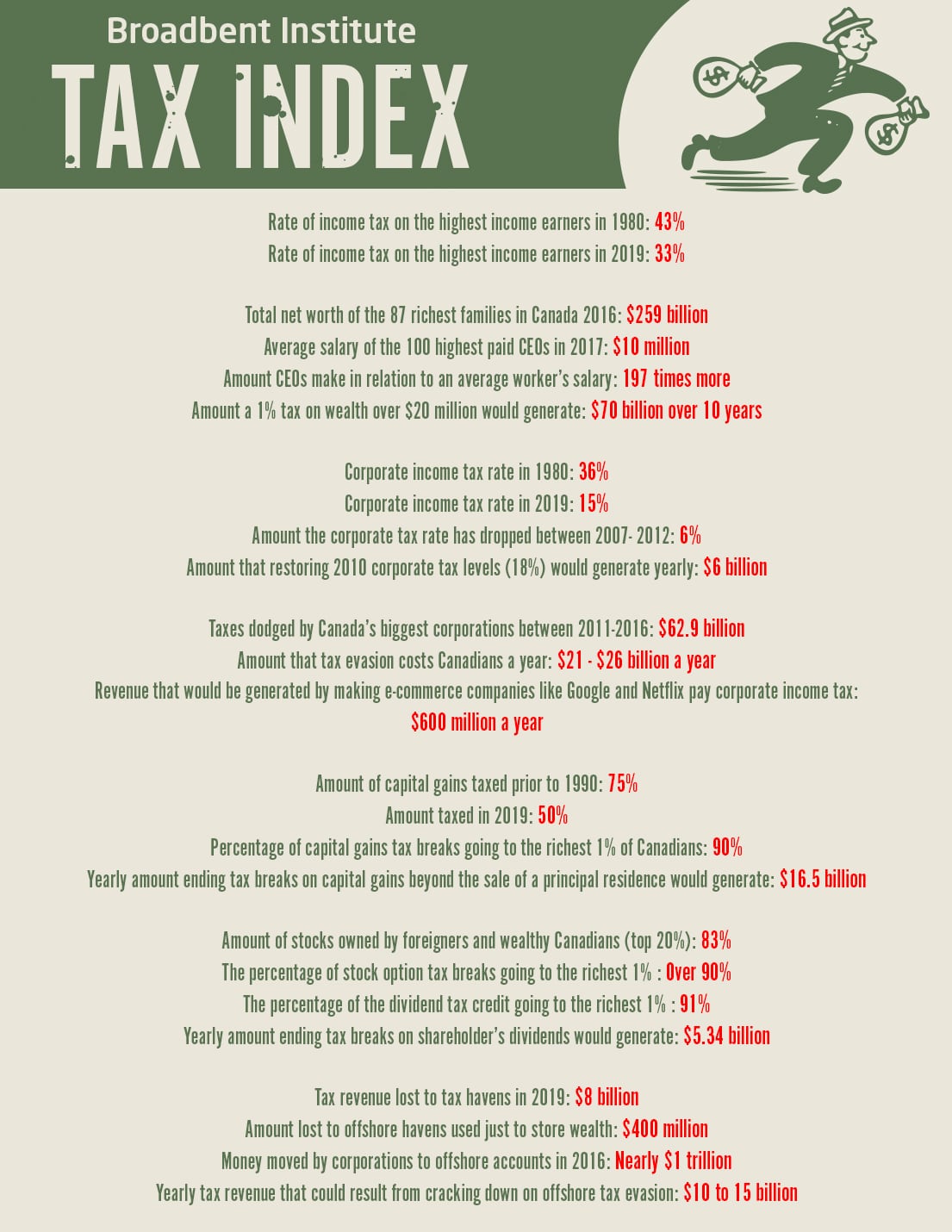

Now the Broadbent Institute has released some interesting facts and figures they’ve gathered about how taxation in Canada has been collected – how much from whom, and what some loop-holes have cost our country – going back as long as 40 years, to 1980. (Older people like me can pause here to wrap our heads around the fact that 1980 is, in fact, nearly 40 years ago.)

We can contemplate those facts and figures, and consider what tax policies are supported by which politicians and parties, and begin using that information to guide our voting the next time we have an opportunity. Here’s the graphic; supporting references follow.

References below:

- Canadian Centre for Policy Alternative. (2018). Alternative Federal Budget 2018. Retrieved from https://www.policyalternatives.ca/sites/default/files/uploads/publications/National%20Office/2018/02/Alternative_Federal_Budget2018.pdf

- Canadians for Tax Fairness. (2019). Canadian corporate cash in top 12 tax havens increases by 10% to all-time high in 2018. Retrieved from https://www.taxfairness.ca/en/press_release/2019-04/canadian-corporate-cash-top-12-tax-havens-increases-10-all-time-high-2018

- CBC News. (2000). A primer on capital gains taxes in Canada. Retrieved from https://www.cbc.ca/news/business/a-primer-on-capital-gains-taxes-in-canada-1.231145

- Department of FInance Canada. (1981). Budget Papers. Retrieved from https://www.budget.gc.ca/pdfarch/1981-pap-eng.pdf

- Forrest, M. (2019). Federal NDP's proposed 'super-wealth tax' could raise $70B over 10 years, budget watchdog finds. Retireved from https://nationalpost.com/news/politics/election-2019/federal-ndps-proposed-super-wealth-tax-could-raise-70b-over-10-years-budget-watchdog-finds

- Government of Canada. (2018). Capital Gains – 2018. Retrieved from https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/t4037/capital-gains-2016.html

- Government of Canada. (2019). Canadian income tax rates for individuals – current and previous years. Retrieved from https://www.canada.ca/en/revenue-agency/services/tax/individuals/frequently-asked-questions-individuals/canadian-income-tax-rates-individuals-current-previous-years.html

- Government of Canada. (2019). Corporation Tax Rates. Retrieved from https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/corporations/corporation-tax-rates.html

- Government of Canada. (2019). Tax Gap: A brief overview. Retrieved from https://www.canada.ca/en/revenue-agency/programs/about-canada-revenue-agency-cra/corporate-reports-information/tax-gap-overview.html

- Kassam, A. (2018). Canada's richest 87 families have same wealth as 12 million people, report says. Retrieved from https://www.theguardian.com/world/2018/jul/31/canada-richest-families-same-wealth-12-million-people-report

- Macdonald. D. (2016) Out of the Shadows Shining a light on Canada’s unequal distribution of federal tax expenditures. Retrieved from https://www.policyalternatives.ca/sites/default/files/uploads/publications/National%20Office/2016/11/Out_of_the_Shadows.pdf

- Macdonald, D. (2019). Mint Condition CEO pay in Canada. Retrieved from https://www.policyalternatives.ca/sites/default/files/uploads/publications/National%20Office/2019/01/Mint%20condition.pdf

- Murphy, B., Veall, M. & Wolfson, M. (2015). Top-End Progressivity and Federal Tax Preferences in Canada: Canadian Tax Journal. 63.3, 661-88

- Oved, C. M, Heaps, A. A, Toby. & Yow, M. (2017). Canada’s Corporations Pay Less Than You Think. The Toronto Star. Retrieved from http://projects.thestar.com/canadas-corporations-pay-less-tax-than-you-think

- Oved, C. M & Cribb. R. (2019). Legal tax dodges cost Canada $25B, PBO study says. Retrieved from https://www.thestar.com/news/investigations/2019/06/20/legal-tax-dodges-cost-canada-25b-pbo-study-says.html

- Stuckey, B & Yong, A. (2011). A Prime of Federal Corporate Tax Rates. Retrieved from https://lop.parl.ca/staticfiles/PublicWebsite/Home/ResearchPublications/InBriefs/PDF/2011-44-e.pdf