Celgar speaks: the other side of a contentious taxation coin

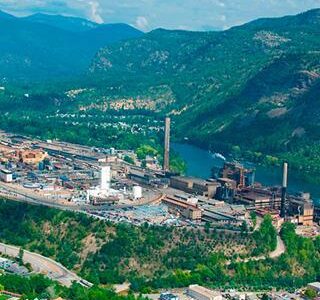

Celgar manager Al Hitzroth shared some of his company’s perspectives today regarding a tax dispute between Celgar and the City of Castlegar, discussing a conflict that has been gaining widespread media attention since it began in July.

The issue had arisen months before that, in fact, when Celgar demanded a 50-per-cent tax cut in December 2008, but took centre stage when Celgar, in July 2009, declined to pay its $3.6-million municipal tax bill, filing suit against the city in B.C. Supreme court instead, citing “unreasonable tax rates”.

The company has since paid out the portion of the bill owed the region district – roughly $375,000 – leaving $3.2 million outstanding.

Hitzroth said, in previous interviews with The Source, that such a dramatic move was simply the only way to get the city’s attention, as previous pleas for reduced tax rates went unanswered. Today, he said he wants to continue ongoing dialogue with the city, but does not concur with Mayor Lawrence Chernoff’s contention that, for said dialogue to happen on a level playing field, the tax bill must first be paid in full.

In addressing the myriad issues that have arisen since July, Hitzroth spoke first to the city’s request for an expedited court date in January 2010. He said he understands why it might look like Celgar was being obstreperous by saying “no” to the January court date, but the issue was in no way sinister and was, in fact, a matter of simple logistics.

“I believe the issue was just that our lawyer wasn’t available for the dates the city’s lawyer proposed,” he said.

As for taking the lawsuit off the table and paying out the bill, he said there are a variety of reasons why that’s not a good solution from Celgar’s perspective. He said the steps were taken in the first place to get the city and the province paying attention, and finally listening to Celgar’s concerns, and the mill simply cannot afford a return to the status quo – which might well happen if the matter’s urgency is removed by Celgar dropping its suit and paying the tax bill.

“Clearly, we need a resolve – we need it brought to a level where people are paying attention,” he said.

He also said a recent federal announcement of almost $60 million in grant funding ($40 million now for the mill’s green energy project and a potential $17.7 million for future qualifying projects) is, in some ways, related to the municipal tax issue – but not in the way some people (including The Source) are presenting it.

“From my perspective, they (the two multi-million-dollar tax amounts) are related in the sense that both are important to ensure the viability of the mill,” he said. “We need both.”

He said the federal funding program was created in an attempt to help companies like Celgar compete against their American counterparts, which received $1 billion in subsidy money – but there’s more to it than that.

“That subsidy money in the U.S. went right into the company coffers, with no strings attached, like there were for us in Canada,” he said. “They could use the money to pay off debt, put it in the bank or pay for capital costs – we can’t just do that.”

He said the Canadian subsidy is very tightly restricted to very specific expenditures – the $40 million has to be spent on the green energy project (and the remaining $17.7 million on projects like it) which will ultimately generate revenue for Celgar, but doesn’t increase the company’s cash flow now.

“If we didn’t get the government infusion (of money) for this green energy project, our (the mill’s) sustainability would be in serious jeopardy,” he said. “The government came along and saved us, and saved our project. It was very timely – we put the project on hold in May, and the government (funding) announcement came in June.”

He said the project won’t actually generate revenue for Celgar until the fourth quarter of 2010 – and that’s if all goes as planned.

In terms of the larger Castlegar/Celgar picture, he said the court case is the least of his concerns.

“To me, the court decision is irrelevant, in a way,” he said. “No matter what happens, the issue remains. It (the taxation model) is a problem – a problem acknowledged by the mayor and council. They’ve agreed the model is broken and needs to be fixed.”

He said Celgar officials are now, through ongoing dialogue, hoping to get to the point where some commitments are made that everyone can live with.

“It’s all about how can we fix this, and what’s the magnitude of the fix,” he said.

No matter how it plays out, he said, both the province and Castlegar have to be involved in creating a solution.

“If you look at municipal taxation, there are two tiers to it: the assessment portion, which is set by the province, and the tax rates, which are set by the city. No matter what, we need to see the engagement of the provincial government.”

He said Celgar, the city and the Union of B.C. Municipalities have all approached the province seeking assistance on the major industry taxation issue, but to little effect.

“The provincial approach seems to be very hands-off; that it’s a municipal issue,” he said. “I still don’t think they’re really stepping up the way they need to.”

In the meantime, he said, he hopes ongoing discussions between Celgar and city representatives will bear fruit that’s palatable to both parties, providing long-term options that address city needs while promising an environment conducive to Celgar’s continued economic viability.